Finance Dashboard in Tableau

Overview

In the complex world of finance, data-driven decisions are crucial. A Finance Dashboard in Tableau offers a comprehensive view of a company's financial health, presenting intricate data in an accessible and interactive format. Whether it's tracking key performance indicators (KPIs), monitoring expense trends, or forecasting revenue, a well-designed dashboard serves as a vital tool for finance professionals. In this guide, we'll walk you through the creation of a versatile Finance Dashboard in Tableau, ensuring you have a robust tool at your fingertips to make informed financial decisions.

What are We Building?

In today's data-driven finance landscape, professionals require an efficient way to visualize, analyze, and interpret vast amounts of financial data. An intuitive and interactive Finance Dashboard can offer solutions to these challenges by presenting financial data in a cohesive manner, aiding in more informed decision-making.

Description of the Problem Statement

Financial data is often scattered across multiple sources, including ledgers, account books, digital platforms, and more. Aggregating this data and drawing actionable insights from it can be time-consuming and error-prone. The primary challenge is to centralize this data and present it in an interactive and understandable format. This helps finance professionals identify trends, anomalies, and potential areas of concern or opportunity. Our goal is to design a Finance Dashboard in Tableau that addresses these challenges, offering a consolidated view of financial data and promoting efficient data-driven decision-making.

Pre-requisites

To develop an efficient Finance Dashboard in Tableau, it's crucial to understand the different metrics and parameters that drive financial decision-making. Each metric provides a unique lens to view the financial health and performance of a business.

Metrics for Tableau Finance Dashboard

Metrics provide quantifiable measures to assess, compare, and track the performance and profitability of a business over time. Choosing the right metrics is paramount for accurate and actionable insights.

Gross profit margin

Gross profit margin is a crucial financial metric that indicates the percentage of revenue that exceeds the cost of goods sold (COGS). It gives insights into how efficiently a company is producing its goods. A higher gross profit margin indicates that the company retains more revenue relative to its cost of goods sold, suggesting effective cost management. In the dashboard, this metric can be visualized over time, across product lines, or regions to identify trends and areas of opportunity or concern.

Operating profit margin:

Operating profit margin is another essential financial metric that measures the proportion of revenue left after deducting both the cost of goods sold (COGS) and operating expenses. Unlike gross profit margin, it considers all the operational costs associated with running the business. A high operating profit margin indicates that the company is managing its operating costs well and generating more profit from its operations. Tracking this metric in a dashboard can help businesses spot inefficiencies in their operations and make strategic decisions to improve profitability.

Operating expense ratio (OER):

Operating expense ratio is a measure of operational efficiency, calculated by dividing total operating expenses by net revenue. This ratio highlights what proportion of a company's revenue is used up by operating expenses, which can include rent, utilities, salaries, and other day-to-day operational costs. A lower OER indicates that a business is operating more efficiently, as it spends less to earn each dollar of revenue. Monitoring the OER in a finance dashboard can help companies track their spending patterns and make informed decisions to optimize operational costs.

Net profit margin:

Net profit margin is a critical financial metric that provides insights into the overall profitability of a business. It is calculated by dividing net profit by total revenue, then multiplying by 100 to get a percentage. This margin reveals how much of every dollar earned is translated into profits after all expenses are accounted for. A higher net profit margin indicates good financial health and efficiency in managing expenses. By tracking this metric on a finance dashboard, businesses can understand their profitability trend and make decisions to either cut costs or boost revenue.

Working capital:

Working capital is a measure of a company's operational liquidity and its ability to meet short-term obligations. It is calculated as the difference between current assets and current liabilities. Positive working capital suggests that the company can pay off its short-term liabilities with its short-term assets. On the other hand, negative working capital may indicate potential financial trouble. Monitoring working capital on a finance dashboard allows businesses to gauge their short-term financial health and ensure they maintain adequate liquidity to cover operational costs and unexpected expenses.

Berry ratio:

The Berry ratio is a financial metric often used by businesses to assess the efficiency of their operations. It is calculated as the division of gross profit by operating expenses. A Berry ratio greater than 1 indicates that the company's core operations are profitable, while a ratio less than 1 suggests that the company is not generating enough profit to cover its operating expenses. Tracking the Berry ratio on a finance dashboard provides insight into operational efficiency and helps companies identify areas where they may need to reduce costs or improve revenue generation.

Cash conversion cycle:

The cash conversion cycle (CCC) is a key measure of how effectively a company is managing its working capital. It gauges the time taken to convert resources into cash flows. Specifically, the CCC represents the number of days between disbursing cash for raw materials and collecting cash from sales of finished goods. It's computed by adding the days inventory outstanding to the days sales outstanding and then subtracting the days payable outstanding. A shorter CCC is preferable, as it indicates the company is quickly turning its investments into cash. By monitoring the CCC on a finance dashboard, businesses can optimize their operations to improve cash flow and liquidity.

Accounts payable turnover ratio:

The Accounts payable turnover ratio is an important financial metric used to understand the rate at which a company pays off its suppliers. It's calculated by dividing the total purchases by the average accounts payable during a period. A higher ratio indicates that the company is paying off its suppliers at a faster rate, which can be a sign of good financial health or strict payment terms set by suppliers. Conversely, a lower ratio might signal potential liquidity issues or more lenient payment terms. Incorporating this ratio into a finance dashboard can help businesses monitor their short-term liquidity and relationships with suppliers.

Accounts receivable turnover ratio:

The Accounts receivable turnover ratio measures the efficiency with which a company collects payments from its customers. It's found by dividing the total net credit sales by the average accounts receivable during a period. A higher ratio denotes that the company is collecting its receivables more frequently throughout the period, indicating effective credit policies and a strong customer base. On the other hand, a lower ratio might hint at inefficiencies in the collection process or potential issues with credit sales. By keeping an eye on this ratio via a finance dashboard, companies can gauge the effectiveness of their credit policies and the quality of their customer relationships.

How are We Going to Build This?

Creating a comprehensive finance dashboard in Tableau demands both a solid understanding of financial metrics and proficiency with data visualization tools. Our approach will encapsulate the following essential steps:

-

Data Gathering:

The first step revolves around collating all the necessary financial data. This would involve integrating with financial systems, ERPs, or accounting software to fetch real-time or periodic data.

-

Data Cleaning:

Once we have our raw data, we'll sift through it to ensure consistency, eliminate any anomalies, and prepare it for analysis. Financial data can sometimes be messy, and cleaning ensures its accuracy.

-

Design Planning:

Before diving into Tableau, it's prudent to sketch out a rough design of the dashboard. Determine which metrics to highlight, where to position them, and what type of visualizations would convey the information most effectively.

-

Data Integration in Tableau:

Import the curated financial data into Tableau. Utilize Tableau's connectors or import functions to seamlessly bring in your data.

-

Creating Financial Visualizations:

Using the pre-defined metrics like Gross profit margin, Net profit margin, etc., we'll create individual visualizations. Each visualization will provide insights into the company's financial health and performance.

-

Dashboard Assembly:

After all the visualizations are created, we'll assemble them cohesively on a single dashboard. This will involve arranging them in a logical order, ensuring the design is intuitive, and making sure the dashboard provides an overarching view of the company's finances.

By adhering to this systematic approach, we ensure that our finance dashboard isn't just visually appealing but is also robust in terms of data integrity and utility.

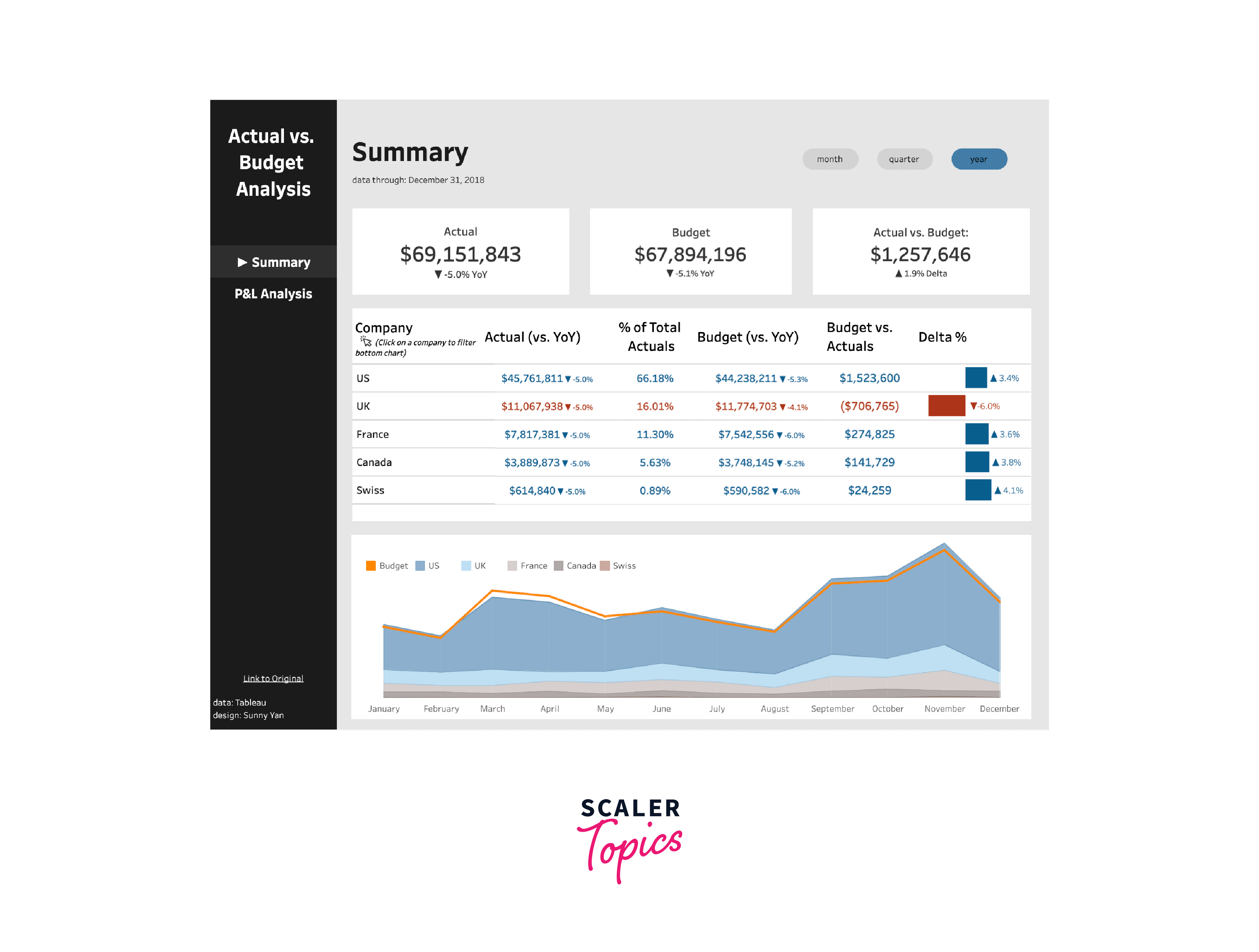

Final Output

Building the Finance Dashboard in Tableau

Data Connection

The foundation of every dashboard in Tableau is the data source. Without connecting to a reliable and accurate data source, even the most beautifully crafted dashboard can lead to incorrect insights. Let’s understand the steps to connect our data to Tableau:

-

Selecting Data Source:

Start Tableau and choose the type of data source you want to connect to. Tableau provides a range of connectors, whether your data is in Excel, SQL, cloud-based storage, or other popular data management systems.

-

Importing Data:

Navigate to the location of your dataset. If your dataset is an Excel file, for instance, find the file and select the sheet you want to import. For databases, you might need connection details or credentials.

-

Previewing Data:

Once connected, Tableau will provide a preview of the data. This step is essential to ensure that the data is being read correctly, and there aren’t any issues with formatting or missing values.

-

Joining Tables (if necessary):

If your financial data is spread across multiple tables or sheets, use Tableau’s drag-and-drop interface to join them. Ensure that the join conditions are correct to avoid data discrepancies.

-

Data Type Verification:

Check each field to ensure that Tableau has correctly identified its data type. For instance, ensure that date fields are recognized as dates and numerical metrics like ‘Gross Profit Margin’ are recognized as numbers or percentages.

-

Live vs. Extract:

Decide if you want to create a live connection or an extract. A live connection will always reflect the most recent data, whereas an extract is a static snapshot. For large datasets, extracts can boost performance.

-

Save Data Source:

Once satisfied with the connection and preview, save the data source. This step ensures you can quickly reconnect in future sessions without redoing the initial setup.

Establishing a proper data connection is crucial. Any errors or oversights at this stage could propagate throughout your entire dashboard, leading to misleading visualizations and potentially incorrect financial insights.

Data Model Creation

Creating a robust data model is paramount for building an efficient and accurate finance dashboard. This process involves organizing the connected data in a way that's conducive to analysis and visualization in Tableau. Here's how you can go about crafting a useful data model for your financial insights:

-

Understanding the Financial Metrics:

Before diving into the data model, understand the financial metrics like Gross Profit Margin, Operating Profit Margin, etc. Knowing what these metrics represent and how they're calculated will guide your data modeling decisions.

-

Hierarchies and Dimensions:

Identify the hierarchies in your data. For instance, if your financial data spans multiple years, you can create a year > quarter > month hierarchy. This hierarchy allows users to drill down from a broader view (annual) to more granular insights (monthly).

-

Calculated Fields:

Tableau provides a powerful interface to create custom calculations. For metrics like 'Operating Expense Ratio' or 'Net Profit Margin', you can create calculated fields that will automatically compute the values based on the raw data.

-

Data Relationships:

Ensure that relationships between different data tables or sheets are correctly defined. This step is especially crucial if you're working with data from different sources or departments. Properly defined relationships prevent duplication and ensure accuracy in aggregations.

-

Aggregations and Groupings:

Group data where necessary. For instance, you might want to group operating expenses under broader categories like 'Marketing', 'R&D', and 'Administrative'. Such groupings can simplify your visualizations and make the dashboard more readable.

-

Filters and Sets:

Create sets for common groupings or segments. For example, if you want a quick way to view metrics for a particular region or product line, sets can be incredibly handy. Also, determine which fields should be available as filters on the dashboard.

-

Data Quality Checks:

Ensure that the data within your model is clean and accurate. Look for any null values, outliers, or discrepancies that might skew the results. Addressing these issues at the modeling stage can save significant time and hassle later.

Crafting a strong data model is like laying the foundation for a building. The strength and accuracy of this foundation determine the integrity of everything built on top of it. It ensures that your Tableau finance dashboard is both reliable and insightful.

Creating Visualizations

The visualization process transforms your raw financial data into comprehensible and insightful graphics. A well-designed visualization in Tableau can help stakeholders quickly grasp complex financial metrics and make informed decisions. Here's how to create impactful visualizations for your finance dashboard:

-

Identify Key Visualizations:

Start by determining which financial metrics are most crucial for your stakeholders. These metrics should take center stage on your dashboard. Commonly used visualizations for finance include line charts for trends, bar charts for comparisons, and pie charts for percentage distributions.

-

Choose the Right Chart Type:

Each metric might be best represented by a specific chart type. For instance:

- Trend Analysis: Use line charts or area charts to showcase financial trends over time.

- Comparison: Bar charts and column charts are perfect for comparing different segments or categories.

- Distribution: Pie or donut charts can help visualize the breakdown of a particular financial metric.

-

Color Coding:

Use consistent and intuitive color coding. For instance, you might want to use shades of green for positive financial performance and shades of red for negative trends. This intuitive color scheme can help users quickly identify areas of concern or success.

-

Interactive Features:

Leverage Tableau's interactive capabilities. Add features like tooltips, drill-down capabilities, and filters. For instance, hovering over a bar might provide more detailed data, or clicking on a segment might offer a more granulated view of that particular data point.

-

Annotations:

Utilize annotations to highlight significant events or anomalies in the data. For example, if there was a significant financial event in a particular month, an annotation can provide context to the spike or drop in the chart.

-

Dashboard Layout:

Consider the dashboard's layout, ensuring that the most critical metrics are prominently displayed. Group related visualizations together for a cohesive flow. For instance, all profitability ratios like gross profit margin, net profit margin, etc., might be displayed in one section, while liquidity metrics might be grouped in another.

-

Performance Optimization:

Ensure that your visualizations load quickly. This might involve reducing the granularity of some data points, optimizing calculations, or using extracts instead of live connections.

Remember, the goal of visualizations is to make complex financial data easily understandable. While aesthetics are essential, prioritize clarity and accuracy. Always take a step back and view the dashboard from the perspective of the end-user, ensuring that the visualizations deliver actionable insights efficiently and intuitively.

Dashboard Reporting

Dashboard reporting involves compiling and presenting the visualizations in a cohesive manner, ensuring that the finance dashboard is user-friendly, intuitive, and delivers actionable insights. Here's a step-by-step approach to effective dashboard reporting in Tableau:

-

Dashboard Layout Design:

Start by sketching a rough layout on paper or using a digital tool. This will help in visualizing the placement of each element and ensuring a logical flow of information.

-

Prioritize Information:

The most critical financial metrics should be prominently displayed at the top or center of your dashboard. Less crucial metrics can be positioned further down or on the periphery.

-

Interactive Elements:

Integrate interactive filters, drop-down lists, and date range selectors, allowing users to customize views according to their needs. This interactivity can help users delve deeper into specific time frames or segments.

-

Use Consistent Design Elements:

Maintain consistency in terms of font styles, sizes, and colors. Uniformity in design enhances readability and avoids confusion.

-

Include Summary and Detailed Views:

While the primary dashboard might provide a high-level overview, consider adding tabs or sections where users can access more detailed views of specific metrics.

-

Mobile Responsiveness:

Ensure that the dashboard is mobile-responsive. With many stakeholders accessing dashboards on the go, a mobile-friendly design is crucial.

-

Annotations and Descriptions:

Beyond visual data representation, include brief descriptions or annotations explaining any anomalies, trends, or crucial insights. This provides context, especially for users who might not be deeply familiar with specific financial metrics.

Remember, a well-structured dashboard reporting process is not just about showcasing data; it's about making the data actionable. Ensure that the dashboard provides clarity, prompts the right questions, and aids in strategic decision-making for the organization.

Testing

The integrity of any dashboard, particularly one that presents financial data, is paramount. Ensuring that the dashboard functions as intended and accurately represents the underlying data is crucial. Here's how to approach the testing phase for the finance dashboard in Tableau:

-

Data Accuracy Testing:

Begin by cross-referencing a sample of the data points on the dashboard with the original data source. This step ensures that there have been no discrepancies in the data transformation and visualization processes.

-

Functional Testing:

Check all interactive elements, such as filters, drop-downs, and clickable segments, to ensure they work as intended. For instance, applying a filter should correctly refine the displayed data without errors or delays.

-

Usability Testing:

Engage a small group of potential end-users and gather their feedback about the dashboard's intuitiveness, ease of navigation, and visual appeal. Their insights can highlight areas for improvement from a user experience perspective.

-

Performance Testing:

Load times and responsiveness are vital for a seamless user experience. Ensure that the dashboard loads quickly, even when handling vast datasets or during peak usage times.

-

Mobile Testing:

Given the increasing use of mobile devices to access dashboards, it's crucial to test the dashboard's mobile responsiveness. Check its appearance and functionality on various screen sizes and devices.

-

Security Testing:

Financial data is sensitive. Ensure that access controls are in place, and only authorized users can view or interact with the dashboard. Test different user roles to confirm that permissions and restrictions are working correctly.

-

Stress Testing:

Push the dashboard to its limits by simulating a large number of users accessing it simultaneously. This step can help identify any potential bottlenecks or performance issues.

-

Iterative Testing:

As you make changes based on feedback or identified issues, continuously test the dashboard to ensure no new problems arise and previously addressed issues remain resolved.

-

Documentation Review:

Ensure that any associated documentation, like user manuals or FAQs, is accurate and reflects the dashboard's final version.

Conducting thorough tests provides assurance that the finance dashboard is reliable, user-friendly, and secure. It's a step that, while time-consuming, ensures the end product is of the highest quality and meets the intended objectives.

Sure! Let's proceed with the heading "What’s next" and delve into the subheading "Tableau Finance Dashboard Examples":

What’s Next

For those eager to take their Tableau finance dashboards to the next level, there are several advanced dashboards that you can explore and implement. These dashboards serve as a comprehensive tool for financial analysts, CFOs, and other finance professionals.

Tableau Finance Dashboard Examples

-

Investment Analysis Dashboard:

- A comprehensive tool for tracking the performance of various investments.

- Compare the returns of different asset classes or individual stocks.

- View historical performance, analyze risk, and assess portfolio diversification.

-

Cash Flow Analysis Dashboard:

- Monitor the inflows and outflows of cash within a business.

- Track cash flow trends over monthly, quarterly, or annual periods.

- Identify potential liquidity issues or opportunities for reinvestment.

-

Financial Forecasting Dashboard:

- Project future revenues, costs, and profitability.

- Use historical data and predictive analytics to drive forecasts.

- Adjust scenarios to view best-case, worst-case, and likely financial outcomes.

-

Credit & Debt Analysis Dashboard:

- Track outstanding debts, interest rates, and repayment schedules.

- Monitor credit scores, credit limits, and utilization rates.

- Identify opportunities for debt consolidation or refinancing.

-

Tax Planning Dashboard:

- Organize and visualize taxable income, deductions, and credits.

- Estimate annual tax liabilities and effective tax rates.

- Plan for potential tax-saving opportunities.

-

Mergers & Acquisitions Analysis Dashboard:

- Analyze potential M&A targets or partnerships.

- Compare financial health, valuations, and strategic fit.

- Visualize post-merger synergies and potential integration challenges.

These are just a few examples of the myriad of finance dashboards that can be built using Tableau. By diving deep into these examples, readers can further hone their Tableau skills and provide invaluable insights to their organization's finance team.

Conclusion

-

Tableau offers unparalleled capabilities for creating comprehensive finance dashboards that can visualize complex financial data in a user-friendly manner.

-

Metrics such as gross profit margin, operating expense ratio, and cash conversion cycle are essential KPIs for any finance team, and Tableau dashboards can monitor and analyze these in real-time.

-

Customizing and integrating advanced financial analytics like investment analysis, cash flow projections, and M&A evaluations further augment the potential of these dashboards.

-

As the finance world becomes increasingly data-driven, mastering tools like Tableau becomes pivotal for professionals to stay ahead and provide actionable insights.

-

With numerous examples and templates available, there's no better time for readers to explore and expand their repertoire in creating advanced financial dashboards using Tableau.